A Mountain of Unsold Cannabis

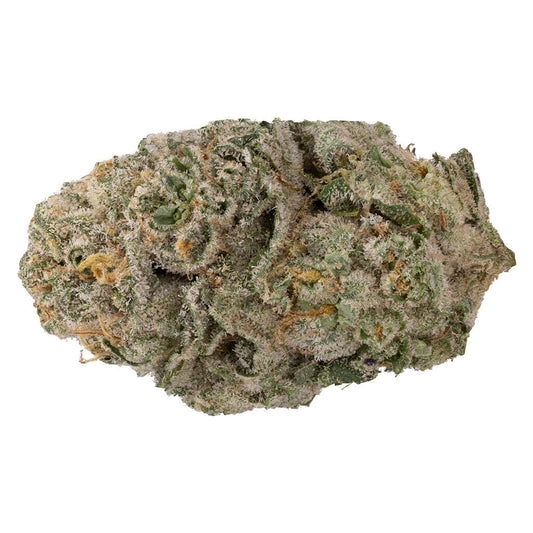

Canadian cannabis operators faced a daunting challenge in 2022 and early 2023: an overwhelming surplus of unsold inventory. Health Canada's data revealed a staggering 611.7 million grams of unpackaged cannabis were destroyed in 2022 alone, a 44% increase from the previous year. This surge highlighted the ongoing mismatch between supply and consumer demand in the Canadian market.

Since legalization, over 1.7 billion grams of unsold dried flower and 24 million packaged products have been destroyed. However, Health Canada's figures only accounted for unpackaged cannabis, suggesting the actual total was even higher.

The Root of the Problem

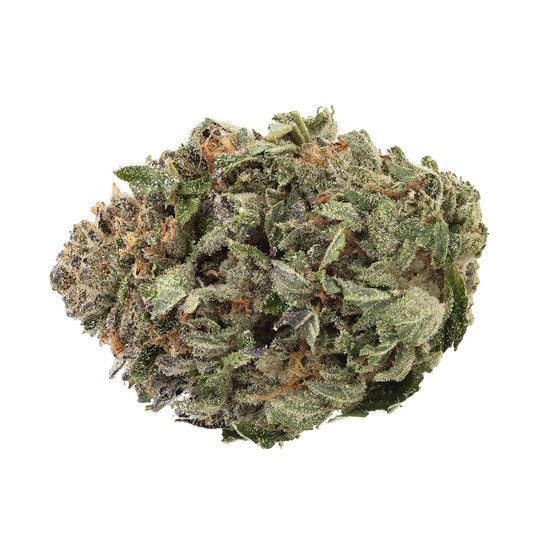

The primary reasons for this massive destruction were the age and low THC content of the products. Industry veteran Farrell Miller emphasized that aged and low-THC cannabis lacked appeal to both manufacturers and consumers.

The post-legalization rush among licensed cultivators to mass-produce cannabis, driven by investor expectations, led to an oversupply. Large-scale greenhouses often failed to produce the high-quality, high-potency marijuana desired by consumers.

Additionally, the closure of cannabis-related businesses due to insolvency resulted in the destruction of unsold products, a regulatory requirement.

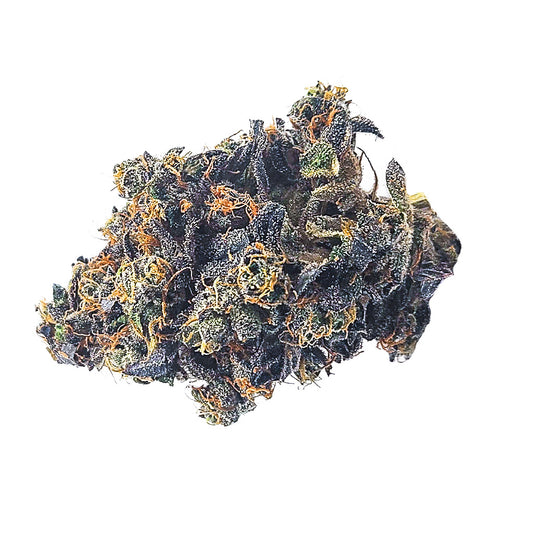

A Call for Reform

Experts like Marie Sweeney advocated for improved coordination between federal and provincial regulators, along with cannabis license holders. Stricter oversight, enhanced data sharing, and aligned policies were deemed essential to manage excess production and meet consumer demands for higher THC content products.

The industry sought to find a balance between production and market needs to mitigate the surplus. By adapting production strategies and aligning regulatory efforts, the Canadian cannabis industry aimed to gradually reduce the excess inventory and achieve a more sustainable market.

Here's How Much Debt Canada's Biggest Cannabis Companies Are In

Tilray (TLRY), with its headquarters in Nanaimo, British Columbia, was established in 2013 and has since become a significant player in the medical cannabis market worldwide. As of May 31, 2023, the company's debt position stood at a substantial CA$590.131 million. With strategic decisions like their recent acquisition of HEXO, a Canadian competitor, it's evident that Tilray is keen on expanding its footprint in the cannabis industry.

Cronos Group (CRON), Hailing from Toronto and established in 2012, Cronos Group has made a significant impact with its range of THC and CBD products. Their commitment to transparent and age-appropriate marketing is commendable. As of December 31, 2022, the company's debt stood at a modest CA$3.876 million. Such a relatively low debt, when compared with its industry peers, indicates a conservative financial stance, potentially attracting risk-averse investors.

TerrAscend (TRSSF), TerrAscend, based in Mississauga, Ontario, and founded in 2017, maintains a strong presence in the U.S., operating sizeable cultivation facilities in several states. Their balance sheet, as of June 30, 2023, indicates a total debt of approximately CA$204.328 million.. Their strategic partnerships, such as the one with international cannabis brand Cookies, indicate a growth-oriented approach that comes with its set of financial challenges.

Canopy Growth (CGC), Operating internationally under more than 20 brand names, Canopy Growth has its roots in Smith Falls, Ontario. Established in 2014, the company's total debt stood at CA$1.306 billion as of May 2023. With a wide array of products ranging from vapes to skincare, Canopy Growth's diverse offerings come with a sizable debt figure.

Aurora Cannabis (ACB), Aurora Cannabis, headquartered in Edmonton and established in 2006, is making waves in the global cannabis sector, covering 25 countries. As of March 2023, Aurora Cannabis reported a debt of CA$178.3 million, marking a notable reduction from CA$334.0 million in the previous year. However, the company also held a cash position of CA$234.9 million, resulting in a net cash situation of CA$56.6 million.

Government Debt in the Canadian Cannabis Industry

Recent data from MJBizDaily highlights a growing concern within the Canadian cannabis industry: the increasing number of insolvent companies owing significant debts to the federal government. The Canada Revenue Agency and Health Canada are frequently among the top creditors, reflecting the high fees and taxes imposed on the sector. Companies like Tantalus Labs have owed substantial amounts to the government, indicating this is not an isolated issue. Despite Canada's progressive cannabis policies, the industry faces financial challenges due to aggressive expansion and the complexities of a rapidly evolving market. The financial health of Canadian cannabis companies will be crucial in determining the industry's future.

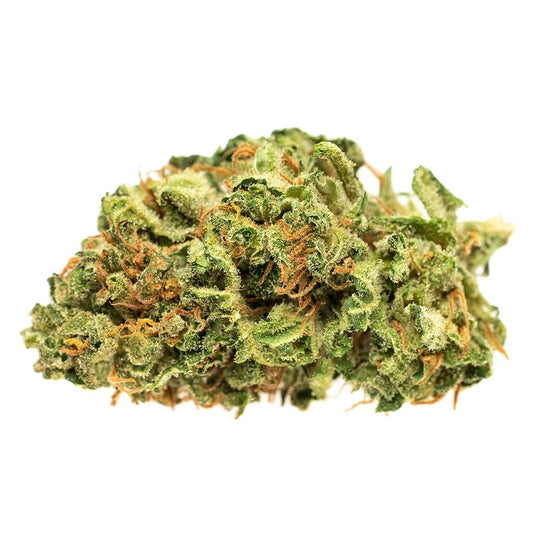

Legal Cannabis Purchases Surge to 73%, Marking a Significant Rise from 2019's 37%, Reports Health Canada

A recent Health Canada survey found that 73 percent of Canadians now purchase cannabis legally, up from 37 percent in 2019. The most popular products are dried flower, edibles, and vape pens. While average monthly spending has decreased, the survey suggests that many Canadians continue to use cannabis regularly. However, experts caution that the data may not fully reflect the actual usage due to social stigma.